Cautious Gen Zs are restricting their spend in pubs and clubs and are instead splashing their cash - on insurance

A poll of 2,000 adults has revealed the nation’s spending priorities for the next 12 months.

More than one in three (35 per cent) 18–24-year-olds plan to spend more on insurance – compared to just 11 per cent of 45–54-year-olds.

Advertisement

Hide AdAdvertisement

Hide AdIt comes as Gen Z were found to already have more insurance coverage for their personal belongings than older age groups.

The younger generation are four times more likely to insure their jewellery than 55-64 year-olds (35 per cent to eight per cent respectively) and twice as likely to insure their watch (26 per cent) compared to the same age group.

It also emerged 37 per cent of 18–24-year-olds are set to spend more on experiences with family – compared to just one in 10 55–64-year-olds.

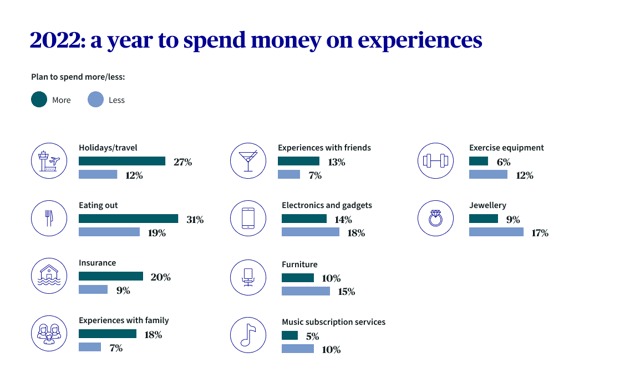

Among all age groups, eating out (31 per cent), holidays and travel (27 per cent) and clothes (22 per cent) are the things they are looking to spend more money on.

The nightlife industry will struggle

Advertisement

Hide AdAdvertisement

Hide AdHowever, the UK’s vibrant nightlife sector may struggle, as just one in 10 plan to spend more money in pubs, clubs and on alcohol.

Claudio Gienal, CEO at AXA UK and Ireland, which commissioned the research, said: “The cost-of-living crisis has understandably made many people nervous about what lies ahead.

“The Chancellor’s move to lower the basic rate of income tax from 20 per cent to 19 per cent, an increase in the threshold for paying National Insurance (NI) by £3,000 and fuel duty being slashed by 5p shows the government knows budgets are squeezed.

“But despite this challenging climate, our research highlights the value we put on experiences with family and friends and the importance of spending time together.

Advertisement

Hide AdAdvertisement

Hide Ad“In these uncertain times, it’s also interesting that younger age groups are most likely to protect their goods via insurance and people generally plan to buy more insurance in the coming year.

“This suggests they don’t see insurance as a luxury but as a vital safety net which allows them to get on with their life and do the things they love.”

Tightening the purse this year

The study also found that when it comes to tightening the purse strings over the next 12 months, 24 per cent of adults plan to spend less on clothes, while others will cut back on eating out (19 per cent) and buying electronics and gadgets (18 per cent).

Others will also reduce their expenditure on jewellery (17 per cent) and home improvements (16 per cent).

Advertisement

Hide AdAdvertisement

Hide AdAlmost one in four (24 per cent) Gen Zs are planning to spend less on cars next year, while more than a quarter of 45–54-year-olds expect to curb their eating out habits.

But while 60 per cent of men believe themselves to be careful shoppers compared to 53 per cent of women, they spend more on impulse buys - £21 a week compared to £16.60 a week.

Although Gen Z spent more than any other age group on impulse buys, splurging £28.80 per week – compared to just £11.90 of those aged 55-64.

And the younger generation are planning to spend three times as much money on takeaway coffee than the over 55s.

Advertisement

Hide AdAdvertisement

Hide AdLondoners splashed £30.30 on impulse buys, with Northern Ireland (£23.80) and the north east (£20.80) making up the top three regions.

The East Midlands (£13.20), south west (£14.80) and the south east (£15.40) were the most frugal regions, according to the survey carried out via OnePoll.

Claudio Gienal added: "It’s fascinating to see how the nation is planning to spend its money in the coming months.

“An uncertain economic environment is creating a generational divide, meaning different age groups are prioritising different activities when it comes to their spending.

Advertisement

Hide AdAdvertisement

Hide Ad“The lifting of coronavirus restrictions perhaps explains why more than a quarter of Brits are planning to spend more money on holidays and travel, despite rising inflation and economic uncertainty.”

Gen Z's top spending priorities for the next 12 months

1. Takeaway coffee - 37 per cent

2. Insurance - 35 per cent

3. Clothes - 33 per cent

4. Eating out - 33 per cent

5. Cars and vehicles - 31 per cent

6. Electronics and gadgets - 30 per cent

7. Jewellery - 24 per cent

8. Nightlife socialising such as nightclubs, bars and pubs - 19 per cent

9. Home improvements - 18 per cent

10. Furniture - 16 per cent