Fears over Northampton businesses going insolvent after being kept afloat by government during coronavirus lockdown

and live on Freeview channel 276

Businesses in Northampton kept afloat by government funding will go insolvent as the country comes out of the coronavirus lockdown, experts fear.

A 55 per cent drop in firms filing for insolvency in the town since March may seem like a positive but many may be in effective hibernation until the backing from Whitehall ends.

Advertisement

Hide AdAdvertisement

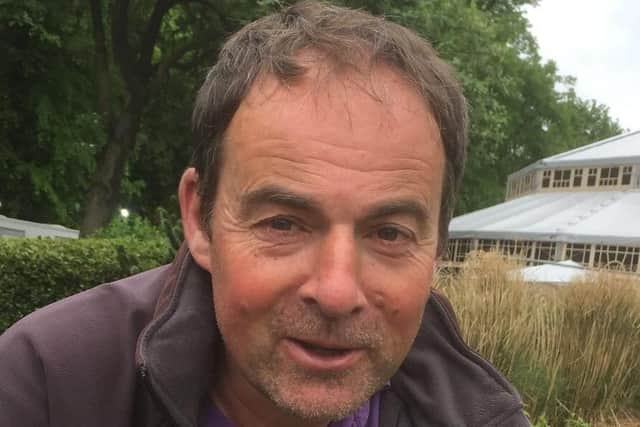

Hide AdRichard Millward has helped run major events across the country including at Silverstone Circuit but is now working as a driver for Waitrose.

He said the margins for festivals and concerts were too small for reduced capacity due to social distancing and the risk was some events simply would not return.

“Several companies that I know are looking at going into administration or have already closed down. It’s sad and also quite worrying," he said.

“We’re going to lose an awful lot of the skill, the talent pool that we have. I think a lot of people are just trying to hang on for as long as possible.”

Advertisement

Hide AdAdvertisement

Hide AdThe BBC Shared Data Unit, which the Chronicle & Echo is part of, analysed data from the London Gazette, the official journal of record that carries notices of corporate insolvencies.

In Northampton, 21 companies have filed for insolvency between March 24, when lockdown started and June 30 - a decrease of 55.3 per cent from 38 for the same period last year.

Nationally around 5,000 companies have filed for insolvency in the same time frame, down compared with 6,500 in roughly the second quarter of 2019.

The research also found a resurgence in new businesses being set up during lockdown, with around 180,000 companies registering in the UK from April to June, including 914 in Northampton.

Advertisement

Hide AdAdvertisement

Hide AdExperts have pointed to the billions in emergency support and changes to insolvency law but warned the true impact is unlikely to appear for months as businesses try to adjust to social distancing, a potential recession and other challenges.

Companies working in information and communication had seen the largest increase in insolvencies.

Those working in the events sector, without a known date for when social distancing restrictions can be lifted, reported the industry was on its knees.

The Event Suppliers and Services Association (ESSA) is also urgently calling for support for large indoor events such as exhibitions and conferences.

Advertisement

Hide AdAdvertisement

Hide AdConferences are provisionally due to be allowed from October 1, subject to the outcome of pilots and social distancing measures.

ESSA director Andrew Harrison said: “Redundancies are already underway, a conservative estimate is as high as 30 per cent within the industry, that is approximately 40,000 direct jobs lost.

“We also estimate 60 per cent of our supply chain businesses will not reopen in October as furlough comes to an end and we do not get the fiscal support so urgently needed by many thousands of companies.”

HM Treasury has spent around £160bn in support for businesses with economic support ranging from loans to business rate relief, tax deferrals, top-up grants, a future fund for blue chip companies and the Bank of England issuing bonds to corporations.

Advertisement

Hide AdAdvertisement

Hide Ad“We’ve outlined a three point plan for supporting businesses through the crisis and spurring the UK’s economic recovery," a government spokesperson said.

“The first stage of this was our £160 billion support package for business that included our job retention scheme, which has protected more than nine million jobs and has been extended until the end of October.

“Earlier this month we announced the second stage of our plan which aims to support, protect, and create jobs across the UK.

"It includes a 15 per cent VAT cut for hospitality, leisure and retail, the Coronavirus Job Retention Scheme Bonus, and job creation through investment in greening homes and buildings.

Advertisement

Hide AdAdvertisement

Hide Ad“As the economy re-opens, we will continue to look at how to adjust our support in a way that ensures people can get back to work, protecting both the UK economy and the livelihoods of people across the country.”

There have also been legal changes - the Corporate Insolvency and Governance Act 2020 means if a company cannot pay its debts due to coronavirus, its creditors cannot apply for it to be wound up until the end of September.

Added to the fact that courts have been less able to handle insolvency cases, this means figures on insolvency are likely to be lower than normal.

Economist Stuart Adam said that without government intervention, the situation might have been worse, but businesses coming out of lockdown faced multiple challenges.

Advertisement

Hide AdAdvertisement

Hide AdSocial distancing measures, reduced spending, larger debt and general market uncertainty could all have an impact, he said.

He said: “Since many firms will undoubtedly shrink or go out of business and jobs will be lost – especially as the furlough scheme comes to an end – it will be vital over the coming months and years for others to start up or expand, to fill the gap and employ those left out of work.”

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.